The US economy is doomed. There’s no two ways about it. It’s between a rock and a hard place, and political leadership is both unaware of and unwilling to do what needs to be done to save it. Before you celebrate, though, that doesn’t mean the end of capitalism. It doesn’t mean the end of neoliberalism. It means we’re all in for a very long very bumpy ride.

At the core of this conundrum is the obvious and painful reality of our sociopathic version of capitalism as experienced by the people who make it run, workers. We all know how the story usually plays out when crisis strikes: businesses get bailouts and consume each other leading to further consolidation, workers get laid off, workers get their pay and hours cut, and workers are expected to sacrifice their own and their family’s well being so that capitalists don’t.

During ‘normal’ crises of capitalism this ‘works’ as intended. Business eventually rebounds, and lagging behind so does unemployment. Wages and benefits may never recover, but that’s not really the concern of the people making the decisions. As the tendency of the rate of profit to fall proceeds apace, austerity first forces workers to tighten their belts for the sake of capital.

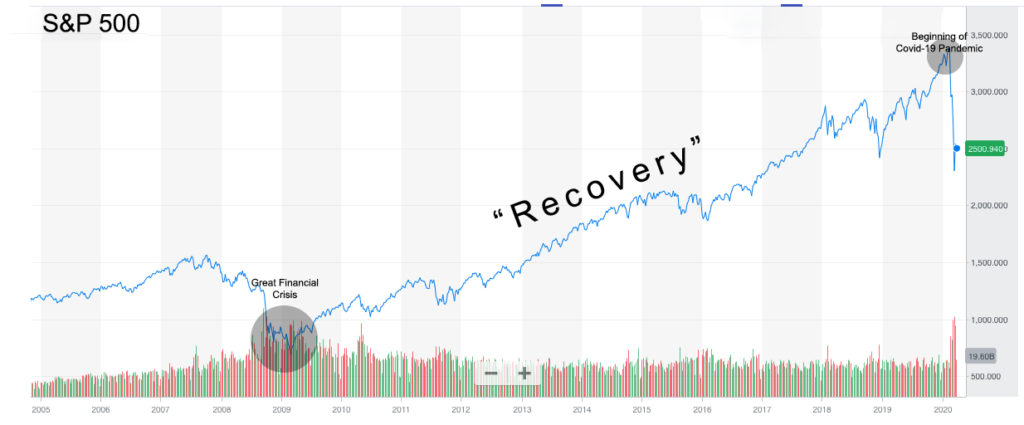

The crisis caused by the global COVID-19 pandemic, though, is different for obvious reasons. Normally, a shock caused by disaster is brief and immediate. The stock markets might tumble momentarily then quickly recover. Even after the 2008 financial crisis the market was rebounding rather quickly once firms had an opportunity to take in the scope of the problem, and not long after soared to new highs. Not this time.

Much has already been made about the economy being “shut down” by social distancing and shelter in place orders. Online a fraction of professional workers are able to work from home, and many more service workers simply aren’t needed when people aren’t patronizing public businesses. Revenues have plunged across the board. From retail to oil demand has plummeted, and by all accounts will continue to do so as the peak in COVID-19 cases is still ahead.

Macy’s has “lost the majority of its sales” and will begin laying off “most of its 125,000 employees”. The largest owner of malls in the US just layed off 30% of its workforce. Fast fashion staple H&M is “weighing” tens of thousands of layoffs. Projections from economists and market watchers are predicting millions more from the likes of hotels, airlines, and other in-person customer intensive industries. The Federal Reserve’s own calculations are predicting unemployment may hit 32%, meaning as many as 47 million jobs eliminated due to the crisis.

The scale of this crisis cannot be overstated. At the height of the Great Depression unemployment topped out at ~25%. It took the New Deal and the mobilization of the entirety of US capital into a planned command economy to fight WWII, and the decimation of every industrial competitor in said war to save the American economy last time. When the state is offering what amounts to a job guarantee via works programs and the military such numbers are much easier to overcome.

This time our genius leaders have offered a $1,200 check, 4 months of unemployment, and an outstretched middle finger to anyone worth less than seven figures. And it’s only going to get worse.

In spite of declarations to the contrary, the US is still very much a consumer economy. The much vaunted gains of the FIRE (finance, insurance, real estate) sector that drove the massive market gains of the time since the Great Recession have proved to be what many of us always knew, smoke and mirrors. Simply moving around vast sums of magic money doled out by the Fed on Wall St. spreadsheets only served to create an enormous asset bubble that’s currently unwinding. With the economy frozen and demand dead business can’t pay its debts, and lenders can’t pay their debts, and the entire house of cards is beginning to crumble.

To save themselves they resort to layoffs, but this simply ends up feeding into the same vicious cycle. With social distancing and mass unemployment people can’t afford or won’t go out to spend and demand drops. When demand drops, revenue drops. When revenue drops payments are missed, and another domino falls.

Our malevolent overlords have no answers. They are trapped in a catch-22 of their own making. Business will continue to bleed money as long as the pandemic prevents normal economic activity. This will lead to unemployment that further suppresses demand. Supply will continue to scale back as production continues to be drawn down or halted entirely. Every “law” of economics is proven to be contingent at best, or outright false at worst.

Suggestions that the economy be “reopened” prematurely will only serve to deepen the crisis by reinflating the already massive spike in coronavirus cases. Simply declaring we’re back open for business won’t solve the demand crisis. You can order people back to work, but you can’t order them to spend.

In the end, it’s clear to any observer without a vested interest in the status quo that simply sacrificing the American worker won’t save capital this time. With over 6 million unemployment claims in the last week March alone, and likely over 10 million for March on the whole, it couldn’t be more clear for capital to survive workers will have to be bailed out as well. This, to them, is intolerable, but soon it will be undeniable. You can’t have nearly 50 million people without a job, and thus a means of subsistence, without unrest. The kind of unrest that sees unpleasant ends for uncaring and unscrupulous actors. No, if they value their wealth, and if history is any guide, their lives, they’ll soon understand.

There is no alternative.

Jean Krill is is the co-editor and co-founder of Zero Balance. His writing navigates the many disparate visions of a radically better future.